Saral Pension Scheme 2025 :- If you are a senior citizen planning a secure future after retirement, the Saral Pension Yojana 2025 could be a beneficial option for you. This scheme is offered by various insurance companies in India and is mandated by the Insurance Regulatory and Development Authority of India (IRDAI). This article covers all essential details—online application process, benefits, premium calculator, interest rates, and required documents.

Table of Contents

Overview of Saral Pension Scheme 2025

| Scheme Name | Saral Pension Scheme 2025 |

| Regulatory Authority | Insurance Regulatory and Development Authority of India (IRDAI) |

| Primary Objective | Providing regular income to senior citizens post-retirement |

| Eligibility | Indian citizens aged 40 to 80 years |

| Official Website | [LIC or respective insurance company’s website] |

Key Dates of Saral Pension Yojana 2025

- Launch Date: Update

- Last Date: Not yet announced

Key Features of Saral Pension Scheme

- Single Premium Immediate Annuity Plan

- Non-participating and Non-linked policy

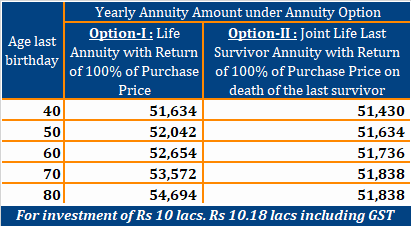

- Two Annuity Options Available:

- Lifetime Pension + 100% Purchase Price Return: Nominee receives the invested amount after the policyholder’s death.

- Joint Life Annuity: Spouse continues receiving the same pension after the policyholder’s death. After both pass away, the purchase price is given to the nominee.

- Payment Options: Monthly, Quarterly, Half-Yearly, or Yearly

- Surrender Option: Available after 6 months

- Loan Facility: Available after 6 months

Benefits of Saral Pension Yojana

- Guaranteed lifelong regular pension

- Financial security for family after the policyholder’s death

- Option to surrender policy after 6 months in case of emergencies

- Tax benefits under Section 80CCC and 10(10A)(iii) of the Income Tax Act, 1961

Premium Calculator

Premium calculation depends on:

| Details | Information |

| Payment Mode | Monthly, Quarterly, Half-Yearly, Yearly |

| Minimum Annuity | Monthly ₹1000, Quarterly ₹3000, Half-Yearly ₹6000, Yearly ₹12000 |

| Loan Facility | Available after 6 months |

| Cancellation Policy | 15 days (Offline) / 30 days (Distance Marketing) |

| Payment System | Paid in arrears (First payment as per chosen mode) |

Eligibility Criteria of Saral Pension Scheme

| Criteria | Details |

| Age Limit | Minimum 40 years, Maximum 80 years |

| Minimum Investment | ₹1000 (Monthly Annuity) |

| Maximum Limit | No upper limit |

| Residency Status | Must be an Indian citizen |

| Purchase Source | LIC or other IRDAI-approved insurance companies |

Required Documents

- Aadhaar Card

- Address Proof

- Bank Account Details

- Income Proof

- Birth Certificate

- Ration Card

- Passport-sized Photo

- Mobile Number

Application Process of Saral Pension Scheme

- Visit the official website of the insurance company (e.g., LIC).

- Click on the “Saral Pension Scheme 2025″ link.

- Fill out the application form on the new page.

- Upload scanned copies of required documents.

- Submit the application.

- Once approved, the policy will be activated.

Pricing Bands

| Category | Purchase Price Range |

| Band 1 | Below ₹2,00,000 |

| Band 2 | ₹2,00,000 – ₹5,00,000 |

| Band 3 | ₹5,00,000 – ₹10,00,000 |

| Band 4 | ₹10,00,000 – ₹25,00,000 |

| Band 5 | ₹25,00,000 or above |

Contact Details

Headquarters:

IRDAI

Survey No. 115/1, Financial District,

Nanakramguda, Gachibowli, Hyderabad – 500032

Phone: +91-40-20204000 / 39328000

Email: irda@irdai.gov.in

Delhi Office:

Jeevan Tara Building, Gate No. 3, Parliament Street,

New Delhi – 110001

Phone: (011) – 2344 4400

Email: irdandro@irdai.gov.in

Mumbai Office:

Royal Insurance Building, J. Tata Road,

Near Churchgate, Mumbai – 400020

Phone: 022 – 22898600

Email: irdamro@irdai.gov.in

Conclusion

If you are between 40 and 80 years old and want a guaranteed monthly income after retirement, the Saral Pension Scheme 2025 is a secure and reliable option. Apply online today and secure your financial future!